Local News

Uganda to miss 2022 oil production deadline

Total E&P’s decision to suspend all oil activities in Uganda after Tullow Oil’s failure to sell a stake of its interests will delay Uganda’s plans of producing first oil, hurting the country’s position of meeting some of its debt obligations, writes BAKER BATTE LULE.

Uganda has racked up a pile of debts – such as the construction of roads and power plants – in the hope that oil money would flow quickly so that the country can service these loans.

Already, the country’s debt to gross domestic product ratio is at a worrying 42 per cent – a few percentage points from the East Africa ceiling of 50 per cent. Defaulting on loans affects a country’s credit profile pushes up interest rates in the market and makes it expensive for the private sector to borrow and create more jobs.

Still, government says not all hope is lost.

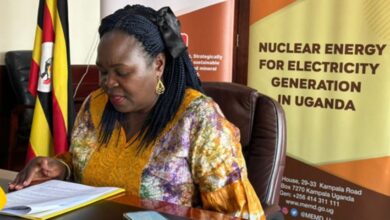

“The collapse of the agreement might have an impact on first oil because we had estimated that it would come three years after the Final Investment Decision [FID] has been signed,” Robert Kasande, the permanent secretary in the ministry of Energy and Mineral Development, said recently on the sidelines of the 2019 sectorial review of the energy sector at the Commonwealth Resort Munyonyo.

The collapse of a $900 million deal in late August, where Tullow Oil wished to sell 21.5 per cent of its stake to France’s Total E&P and China’s Cnooc means Uganda will not beat its 2022 target for oil production to start. The deal failed after the companies disputed the tax measures imposed on it and the treatment of the costs that Total E&P and Cnooc would inherit from Tullow Oil.

Kasande said although they expect setbacks, they are still on course because many of the preliminary activities have already been undertaken.

“Total has a sizeable share of the oil so they just can’t walk away. They have scaled down on the deployment in the field because of the collapse of the farm-down but other activities like the Environmental and Social Impact assessment are continuing,” he said.

Kasande reassured the country that the collapse of the sale and purchase agreement between the oil companies doesn’t mean the end of the oil industry in Uganda.

“What happened is that Tullow Oil was looking for resources to invest. What they have done now is to go back to the market to look for these resources. As this is happening, we are continuing to engage. We are going to have a meeting to see that we stay on course so that the FID is reached at the end of this year,” Kasande said.

He added: “It’s critical at this stage and the companies cannot go away forever because they have a resource that they have found and booked on their stock exchange.” He, however, ruled out amending the country’s laws to appease the interests of the oil companies.

“These are laws that bring value to the country and benchmarked on international best practices… and cannot be changed over a transaction,” Kasande said.

Simon D’Ujang, the state minister for Energy, reaffirmed that they are still in talks with the oil companies and expect a breakthrough soon.

“It’s not strange to have hiccups here and there but the most important thing is for the partners to come on the table and reach an amicable position. Ugandans shouldn’t be worried because all of us have a stake in this program. We have covered a distance [oil production process] and the only way is to try and reach an agreement,” he said.

SOURCE:The Observer