BusinessEnvironmentLocal News

Reading of Uganda’s sh72 trillion budget — as it happened

Reading of Uganda's sh72 trillion budget — as it happened

Many people earning huge taxable income are dodging taxes using several methods, experts have revealed .

Many people earning huge taxable income are dodging taxes using several methods, experts have revealed .

Tax obligation has substantially been relegated to taxpayers whose income, although within the taxable threshold, earn much less and cannot either evade or avoid paying taxes.

r

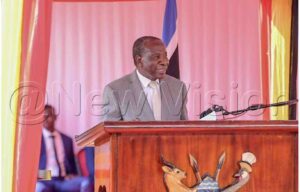

With the Financial Year (FY) 2024/2025 budget amounting to Shs72.1 trillion, up for implementation beginning next month, concerns over how the promises contained in the ambitious budget, which is set to be read today by Finance Minister Matia Kasaija, will be achieved is rife.

Of the Shs72.1 trillion budget, domestic revenue taxes collected internally will contribute Shs32.3 trillion, which is nearly 45 percent; budget support will comprise Shs1.3 trillion, totalling just about two percent; and domestic borrowing will contribute Shs8.9 trillion, translating to 12 percent. Domestic debt refinancing will amount to Shs19.8 trillion, accounting to 27.5 percent of the budget, and project support will make up Shs9.5 trillion, which is about 13 percent.

This implies that debt, whose cost of servicing has put the country in a situation of debt distress and increased vulnerability to a debt crisis, will fund 55 percent of the FY2024/2025 budget, while domestic revenue will finance just about 45 percent of the total budget.

Tax experts and civil society organisations (CSO) say the government doesn’t distinguish between the poor and the rich largely due to the indirect method of tax collection, indiscriminately imposing the same tax burden across the board. Minister Kasaija says the government will depend more on indirect tax because it is easy to collect.

Unlike some employed individuals who are taxed at the source, companies seem to have leeway that many taxpayers don’t. For example, the Value Added Tax (VAT) scam, technically known as a missing trader, a kind of tax fraud perpetuated by mainly companies, has become a fixture. The Ministry of Finance Permanent Secretary and the Secretary to the Treasury, Mr Ramathan Ggoobi, believes between Shs3 trillion and Shs5 trillion, is lost due to VAT fraud and non-compliance every year.

“I can tell you we are fighting this kind of scam and we have secured some convictions against some perpetrators so far,” the Commissioner for Tax Investigation at Uganda Revenue Authority (URA), Mr Denis Kugonza Kateeba, told this reporter in an interview.

This vice involves the formation of companies that have no tangible business except fraudulently issuing invoices to reduce their VAT tax liability. Some businesses can be real but still use fictitious invoices to condense their tax liability. Then there is the falsification or adjustment of invoices. This normally happens at customs. Most of the time the invoices are adjusted downwards, causing revenue loss.

Unearthing non-compliance

According to the URA, their investigations uncovered a disparity between individuals who pay customs duties and those who pay income tax. The findings reveal four individuals who paid more than Shs1 billion in customs taxes, but only two of these paid income tax. In addition, 12 individuals paid more than Shs500 million in customs duties, but none of them remitted income tax.

“Most of these rich fellows have thrived because they have remained informal,” reads part of the taxman findings, adding: “They transact mainly in cash, do not often keep proper books of account, some do not deposit their money in bank accounts and they have less than five employees in most cases.”

Further, whereas individuals, especially employees plying their trade in formally registered entities are taxed at source, much of the income of corporations, including multinational companies across sectors such as telecommunication, banking, extractives, manufacturing, ICT, trade, and commerce rarely pay rightful corporate taxes, also called corporation tax or company tax, which is a type of direct tax levied on the income or capital of corporations and other similar legal entities.

A conservative estimate of more than Shs2 trillion, according to a report on illicit financial flows (IFFs), is being lost every year to illegal activities perpetrated by multinational companies.

The report, the African Union/Economic Commission for Africa High-Level Panel on Illicit Financial Flows from Africa, indicates that multinationals in African countries such as Uganda not only bleed the economy but also starve the National Treasury of much-needed revenue through tax evasion, money laundering, and false declarations.

Corruption

An assessment by CSOs under their umbrella, Civil Society Budget Advocacy Group (CSBAG), reveals that the vice continues to deprive ordinary citizens of the services that are due to them. As a result of this, there has been a decline in donor support, jeopardising critical development aid.

For example, the World Bank in 2022 withheld a $1.5 billion (Shs5.6 trillion) loan to Uganda because of concerns over corruption and mismanagement of public funds and the passing of the Anti-Homosexuality Act (AHA).

The EU reduced its development aid to Uganda by 20 percent because of concerns over financial mismanagement and lack of transparency. Additionally, the US government withheld funding for various development projects in Uganda, such as African Growth and Opportunity Act (AGOA) citing concerns over corruption and fiscal irresponsibility.

According to URA, the category of the wealthy/rich and high-net-income earners continues to be problematic. A report titled, Boosting Revenue Collection through Taxing High Net worth Individuals (HNWIs): The Case of Uganda, reveals that the majority of wealthy Ugandans do not pay taxes even though they earn huge incomes in the country.

To date, less than 10 percent of total tax collection is attributed to wealthy and high-net individuals. This publication also established that HNWIs continue to remit less than five percent of total domestic tax revenue, compared to just about 10 percent that they contribute to international trade taxes, indicating a grave mismatch.

Under the HNWIs category are civil servants and politicians. In most cases, the official salaries of these public servants are often reasonably modest. But, according to URA investigations, some of them amass significant amounts of wealth through unexplained sources and yet they do not pay taxes on this wealth.

An analysis of the URA taxpayer databases indicates a link between some government officials with various commercial enterprises such as schools, hotels, media houses, and land worth billions of shillings with tax evasion and avoidance.

More burden to shoulder

Another report jointly produced by Oxfam and Southern and Eastern Africa Trade, Information and Negotiations Institute (SEATINI Uganda) indicates that Uganda’s fast-growing informal sector accounts for nearly half of the economy, and given that informal businesses are normally unregistered, operate without accounts, have few employees, and often have no fixed location or can easily change address, makes it difficult for the taxman to have them within the tax radar.

Professionals in private businesses such as lawyers, accountants, and engineers, among others, running private businesses in the country are among the biggest tax evaders, choosing to hide in the shadow economy also known as the informal sector with the sole aim of keeping out of taxman radar.

Although the tax incentives and exemptions are expected to free up capital, to enable companies to employ more staff, according to the Value for Money Audit Report on the Management of Tax Incentives and Expenditure in Uganda done by the Office of the Auditor General, this hasn’t been the case.

For example, a total of 22 companies out of the 36 that had obtained the incentives, were performing below the 50 percent threshold and thus had not fully achieved the desired employment levels.

Over the last one year, taxes waived by the government amounted to Shs1.4 trillion, comprising of Shs1.2 trillion waived under the Gazette by Parliament, direct waivers by the minister of Finance to the tune of Shs118.5 billion as well as tax exemptions as per the Income Tax Act under Section 21 granted by the commissioner general amounting to Shs5.5 billion.

What they say…

Julius Mukunda, Executive Director, CSBAG.

The largest source of financing is from Ugandan taxpayers. URA [plans] to collect some Shs32.3 trillion domestically, which is equivalent to 45 percent of the total budget, followed by domestic debt rollover (20 percent), Project Support (13 percent), domestic borrowing (12 percent), and budget support (2 percent).

Most taxes come from key multinationals and local communities pay their portion as well. This is why it is important to have the corporation pay their fair share of taxes because the communities are already doing their best.

Budget support through grants has declined over the years and this will decline even further as Uganda becomes a middle income country. Therefore, a stable source of budget financing is domestic revenue mobilisation.